You have just learned that one of your creditors is starting to take money out of your paycheck or even your bank account. This is called a garnishment. A garnishment is a legal procedure where a portion of your paycheck is taken for the payment of a debt. Garnishments are usually by a creditor that has a court order. Some government agencies can garnish your paycheck without a court order, for debts such as back taxes and student loans. Federal laws limit the amount that a person’s paycheck may be garnished. A garnishment applies to wages, salaries, commissions and bonuses.

You have just learned that one of your creditors is starting to take money out of your paycheck or even your bank account. This is called a garnishment. A garnishment is a legal procedure where a portion of your paycheck is taken for the payment of a debt. Garnishments are usually by a creditor that has a court order. Some government agencies can garnish your paycheck without a court order, for debts such as back taxes and student loans. Federal laws limit the amount that a person’s paycheck may be garnished. A garnishment applies to wages, salaries, commissions and bonuses.

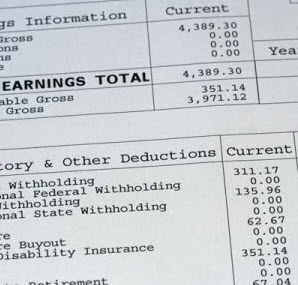

The amount of pay subject to garnishment is based on your “disposable earnings,” which is the amount left after legally required deductions are made. Legally required deductions are federal, state, and local taxes, the employee’s share of social security, Medicare, State unemployment, and required employee retirement. Federal law sets the maximum amount that may be garnished in any workweek or pay period regardless of the number of garnishment orders received by the employer. Garnishments may not exceed 25% of the employee’s disposable earnings, or the amount by which an employee’s disposable earnings are greater than 30 times the federal minimum wage (currently $7.25 an hour).

- If the pay period is weekly and disposable earnings are $217.50 ($7.25 x 30) or less, there can be no garnishment.

- If weekly disposable earnings are more than $217.50 but less than $290.00 ($7.25 x 40), the amount above $217.50 can be garnished ($72.50).

- If the weekly disposable earnings are $290 or more, no more than 25% can be garnished.

There are exceptions to the garnishment limits. The limitations to wage garnishments do not apply to certain bankruptcy court orders or to debts due for federal or state taxes. If a specific state has a different wage garnishment law from Title III, then the law resulting in the lower amount of earnings being taken must be used. Debts that are not related to taxes, but are owed to other federal agencies can be garnished up to 15% of disposable earnings to repay defaulted debts owed to the US government. The Higher Education Act authorizes the Department of Education’s guaranty agencies to garnish up to 10% of disposable earnings to repay defaulted federal student loans.

See chart below for different pay periods regarding garnishments:

Continue Reading ›

Mississippi Consumer Help Blog

Mississippi Consumer Help Blog