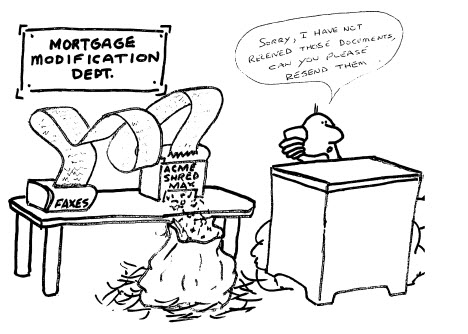

You’re trying to work through the process of getting a modification of your home loan and you can’t seem to ever get the same person on the phone. When you talk to one person, they give you different answers, pass you around, or claim the information you provided was to another department so they need you to repeat it. Maybe they can’t find any record of your information at all. You’ve faxed the same paperwork multiple times – only for it to “disappear” or to “never have arrived”. You’ve mailed the information but “a page or two is missing”. You mail it again and somehow different pages aren’t there now. Is it just you? NO! Can a huge company be this incompetent? Is it a consipiracy? A stall tactic?

Your mortgage company does not want to give you a modification. It’s “let the games begin” time. It’s not your fault. They simply make more money foreclosing. Don’t believe me? Investors are the ones that own your mortgage. The mortgage company or mortgage servicer is simply servicing the loan – collecting your payments and passing them on. Let’s say they make $250 a year for doing this. But if you’re late – hey! They get late fees, can then tack on assessment fees, attorneys fees, modification screening fees (I said screening – they are not incented to actually give you a modification), foreclosure processing fees, and on and on and on. These fees that they get to keep can add up to thousands! And oh yeah – they tell you not to pay your normal note while they are screening you for this modification. Why? Because you will then get farther and farther behind and they will make more and more and more in fees.

There is a way to save your home, regain control of this nightmare, and get back in the driving seat. Read on.

Mississippi Consumer Help Blog

Mississippi Consumer Help Blog